Budget arithmetic is incredibly simple:

Budget Surplus (Deficit) = Tax Revenue – Spending

From this equation, it seems perfectly reasonable that increasing tax revenue would be a sensible solution to eliminating the deficit, but the reality is that the level of tax revenue is completely irrelevant!

How could this be? Let’s look at some budget history.

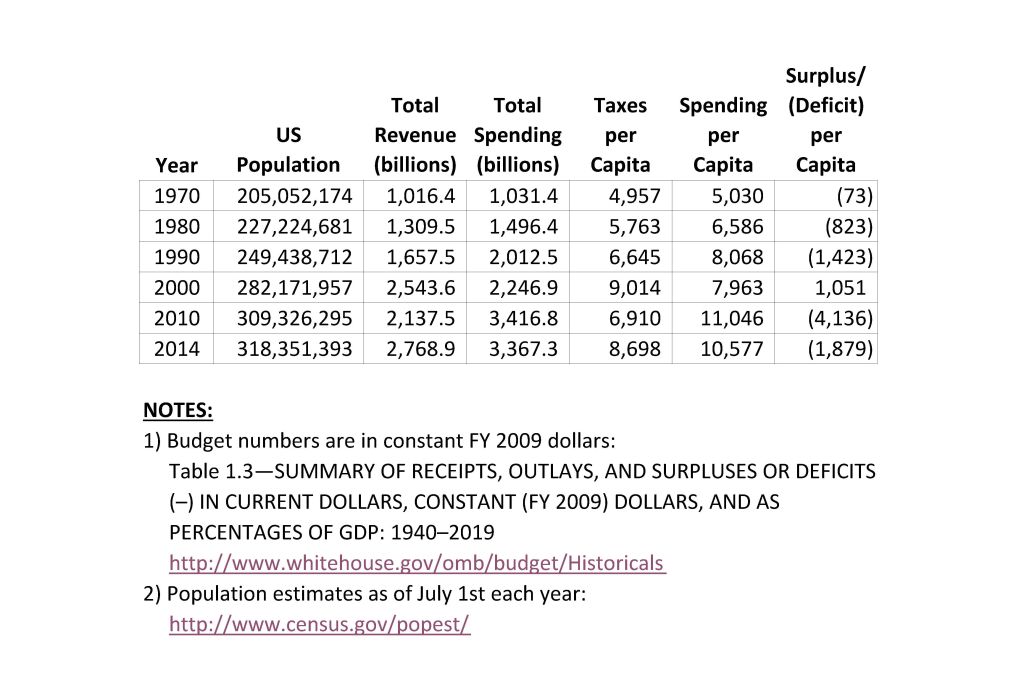

In the 45 fiscal years from 1970 through 2014, we have only had a budget surplus in 4 years (FY 1998 through FY 2001). In other words, we have run a deficit an astonishing 91% of the time. Here is a snapshot of what happened to tax revenue and spending over that time:

From 1970 to 2014, tax revenue per capita increased about 75% in constant, inflation-adjusted dollars. Unfortunately, spending per capita increased about 110%!

Politicians invariably respond to an increase in tax revenue by increasing spending, and quite often they increase spending by more than the increase in tax revenue. This problem isn’t limited to the United States. Many countries have much higher taxes as a percentage of GDP, and they are facing the same budget challenges that we are.

Political incentives are the problem.

There is one simple reason that politicians rarely balance the budget: they don’t want to!

Paying money to the government is not popular, but receiving money from the government is, so there is a built-in bias towards deficit spending. People love all the wonderful things that government buys for us. They just don’t want to pay for it. So politicians give people what they want in exchange for their votes.

Sure, politicians agree that it would be nice to balance the budget some time in the future, but they pretty much always rationalize why it isn’t a good time to balance the budget NOW. Instead, they defer the pain of balancing the budget into the future.

The problem is that when the future arrives, it is the present, and the present is NEVER a popular time to balance the budget!

More income is never a solution for fiscal irresponsibility.

We hear all the time about high-paid celebrities, athletes, and lottery winners going bankrupt. Mike Tyson earned about $300 million over his career, and yet he declared bankruptcy in 2003. Do you think that earning $400 million would have solved his financial difficulties? I seriously doubt it. The problem is that the level of income is irrelevant if you are just going to spend more than you earn anyway.

Giving more money to financially irresponsible people is about the stupidest thing you can do, because it doesn’t make them responsible.

Higher tax revenue will never solve our budget problems. Only spending discipline can do that.

{ 0 comments… add one now }