One pet peeve of mine is the use of sloppy language, and I can think of no better example than the phrase “tax cut.” Does it mean a tax rate cut? A tax base cut? A tax revenue cut? It’s ambiguous. “Tax cut” is most often used to mean a tax rate cut, which we are then supposed to assume will lead to a tax revenue cut, but is this reasonable?

A simplified formula for calculating tax revenue is:

Tax Revenue = Tax Rate X Tax Base [e.g. Taxable Income]

A tax rate cut will obviously lead to reduced tax revenue assuming the tax base doesn’t change. However, this assumption is problematic because we know that changing the tax rate also changes behavior, which changes the tax base.

Cutting the tax rate on something invariably increases the tax base, and raising the tax rate decreases the tax base. For example, raising the tax rate on cigarette sales will reduce cigarette sales (the tax base) because buying cigarettes becomes more expensive. Will the increase in tax rate or the decrease in tax base have the bigger impact on tax revenue?

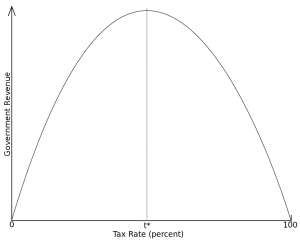

The Laffer Curve

The idea that a tax rate increase could decrease tax revenue is an old one and is famously depicted by the Laffer Curve.

There is some point where raising the tax rate won’t help increase revenue. This makes intuitive sense. Would you even bother to work if the tax rate was 99%? I know that I wouldn’t. The government would raise more tax revenue from me at a rate of only 1% than it would at a tax rate of 99%.

So we know that there has to be some tax rate that maximizes tax revenue. We just don’t know exactly what the rate is.

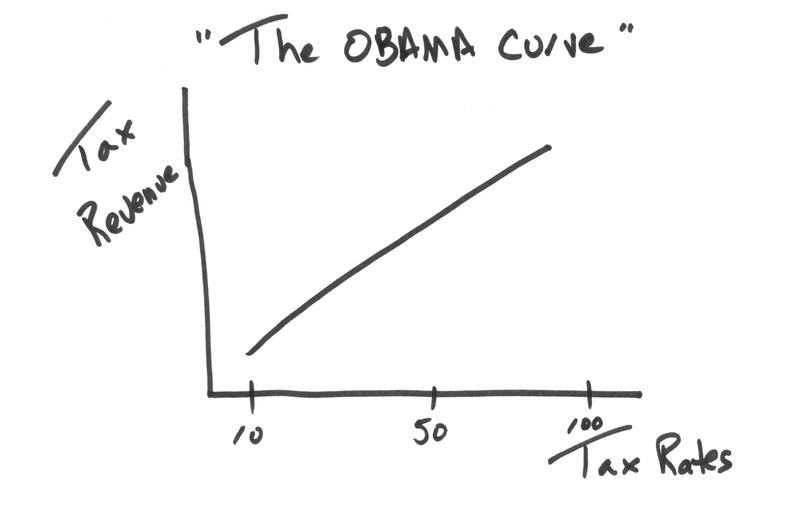

The Obama Curve

Amazingly, despite the clear logic behind the idea, liberals are often very dismissive of the idea that tax revenue could increase after a tax rate cut.

“Steve, the math is the math. You can’t lower rates and raise revenue, unless you’re getting revenue from someplace else. Now, either it’s coming from middle-class families or poor families or it’s coming from folks like you and me that can afford to pay a little more. I mean, I think the average American understands that.”

– President Barack Obama (interview on 60 Minutes)

Andelino had a great depiction of Obama’s absurd viewpoint on his blog:

The “Reagan Tax Cuts”

Consider the so-called “Reagan tax cuts.” Tax rates were slashed dramatically, but tax revenue increased.

Let’s take a look at inflation-adjusted tax revenue per capita. During the Carter Administration (1977-1980), individual income tax revenue per person was about $2,553 in 2009 dollars. For Reagan’s first term (1981-1984), this increased to $2,628 per person, and for his second term (1985-1988), it increased again to $2,746 (an increase of about 7.6% over the revenue during the Carter years). So tax revenue increased despite the top tax rate being reduced from 70% to 28%.

If you are especially perceptive, then you might have guessed that this comparison isn’t necessarily fair. The tax base (in this case taxable income) naturally grows as the economy grows, which means that the tax base would likely have grown over time even if tax rates had not been cut.

A better comparison would be to compare income taxes as a percentage of GDP (i.e. relative to the size of the economy). Here is a chart from the article Why 70% Tax Rates Won’t Work by Alan Reynolds.

As you can see from the chart, tax revenue was higher even when the highest tax rate was only 28%!

The math is the math.

Obama was right. The math is the math. It’s just too bad that he sucks at math.

{ 0 comments… add one now }